Kazakhstan might lower base rate on this coming Friday (26 May 2023). That will press and devaluate the national currency – reports famous economic analyst Eldar Shamsutdinov in his telegram-channel.

Literal translation below:

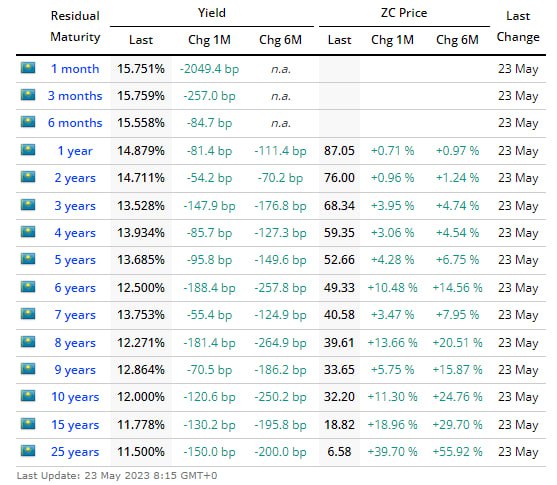

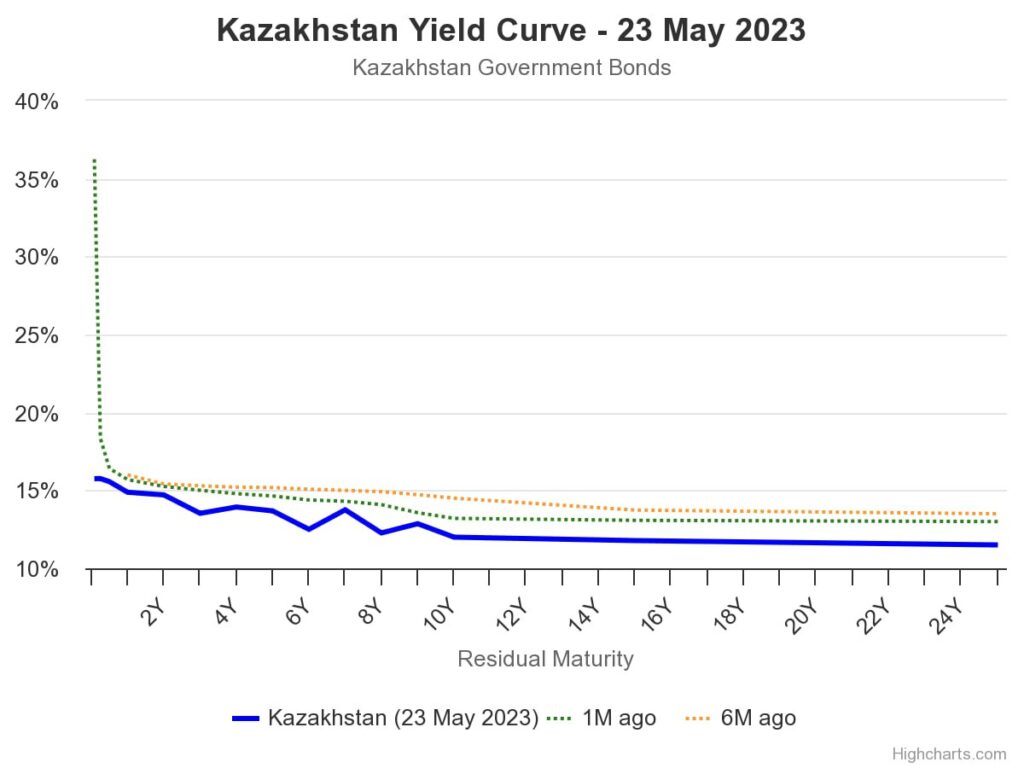

Kazakhstan Finance Ministry borrows money at high interest. The base rate is 12% — the highest in the sovereign rating group (BBB/BBB-).

Positive news is that in the month short and long bond yield fell from 54.2 to 2,049 base points.

The above means that the national debt service expenses will reduce. Also, the above may mean that the National Bank will cut base rate.

Budget Problems

Some explanations are required.

Information regarding borrowings to replenish the national budget do not indicate that we need to urgently cut the base rate.

That means that the budget is not tallying

The budget was compiled based on planned returns from taxes, asset sales and loans. The national budget is not a bank and does not have cash. Budget expenditures are made, when there is cash in place, that is called appropriation.

When money comes with delay or there is the risk that there will be no money, the Finance Ministry has to think where to lend the money.

Growing rates for short public bonds indicate that state needs money urgently,

while investors want more profits, because risks are higher.

Mysterious Budget Gap

Short-term means that the Finance Ministry, as the borrowing party is not willing to take up expensive middle-term (1-5 years) and long-term (5 and more years) liabilities. The Ministry wants a bridge – a short loan prior to a longer one and some revolving loans (taking similar loans one after another).

Speaking easy, there is gap in the budget, and the Finance Ministry is working hard to fill it in

Even if the National Bank base rate was not that high – not high enough to satisfy profteers, i.e. some 8 to 10%, the value of the state bonds would still be high. Without inflation cover, state bonds will be covered by moneys from State Pension Fund or other private sources controlled by state.

As to the base rate, this Friday, the Monetary Policy Committee will hold a meeting, at which the base rate might probabilistically, be cut.

What About Base Rate?

High base rate is pressure on profiteers, who suffer from interest risk and face cheap long-term bonds and expensive short-term loans. In response, profiteers press on the National Bank.

Base rate cut will send incorrect signals to economic agents. Attractiveness of the national currency will suffer. That will automatically press on the exchange rate and increase the USD mass. When people do not trust their national currency, it goes down.

I share the position of colleagues from Jusan Analytics: high external volatility, including oil and nutrition markets drive state towards support of tenge instruments. .

Base rate must be maintained where it is now, otherwise we will see growing inflation and devcaluation of KZT