China’s economy is at the edge of the real estate crisis. Way too many houses, the market is overheated. It appears, the market in China will collapse, and that will echo in nearby economies. Especially, those, who, following Chinese example, were fond of building multi-floors.

Eldar Shamsutdinov, a famous economic observer, discusses the situation in his telegram-channel, as follows:

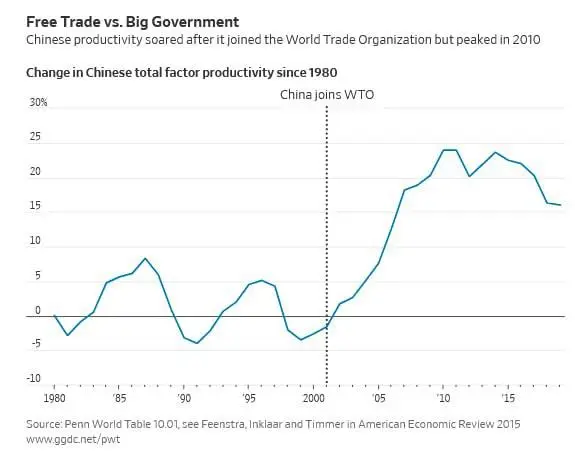

“China has entered the lost decade of investment. Hopes that post-pandemic recovery will help to resume the fast economic growth turned out void. Deflation is coming

Real estate boom resulted in collapse and legacy of enormous debt.

Rich consumers are not willing to pay in cash. Economic observers are now comparing China with Japan, when the latter was entering its Lost Decade.

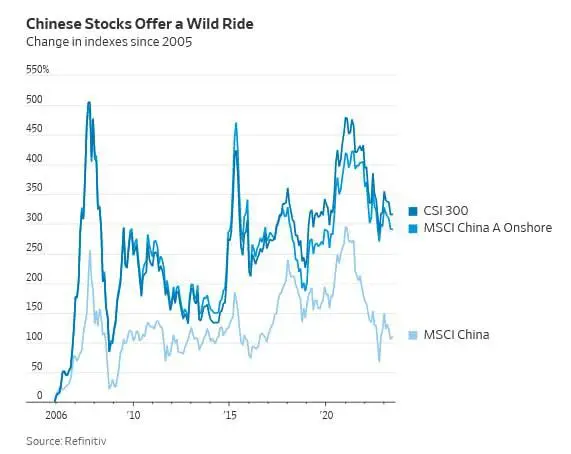

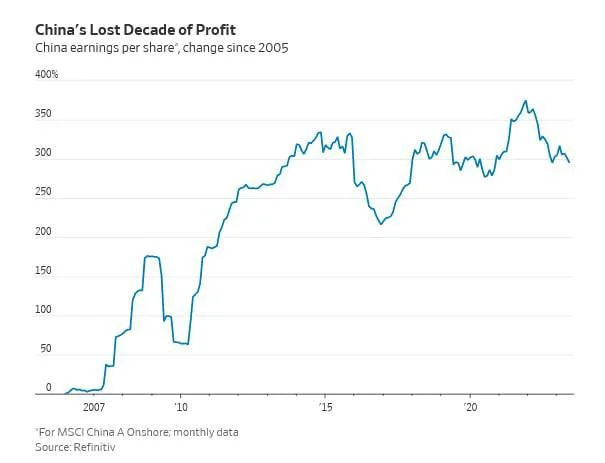

Domestic share prices are lower than in 2007, while earnings per share are same, as in 2013. Chinese shares are the cheapest in the world”.

Beijing’s Reaction

China’s Communist Party leadership have realized that the Chinese economy is suffering from poor consumption, crisis of liquidity in real estate and falling production.

They need to boost up the inner demand (electronics, motor-vehicles) through increase in the incomes of the population. They need to wrestle with unemployment and accelerate the issuance of shares of local bodies of administration.

In the light of above public declarations, the HSI showed +2.1 points. Looks positive, but China is moving towards Lost Decade, like did Japan. Chinese economists insist on the opposite. But the data demonstrates that monetary stimulation does not help, and problems are only accumulating.

Chinese government continue to give loans to problematic developers and pretend things are OK.

It is clear, that end of state support will result in the default of land developers and a chain of bankruptcies, including parties abroad. Economic growth tempo will drop down, but that is a temporary thing, because masses of human resources and capitals will be liberated and directed to other, more productive spheres. Short-term pain will bring long-term benefit”.